Under the new TEA rules[1] (as of November 21, 2019) USCIS is no longer accepting TEA certifications from the individual states, and is instead requiring that I-526 petitions contain separate evidence that a Project qualifies as a TEA and will review that evidence as part of the I-526 adjudication. Rural TEAs are unchanged under the new rules, but high-unemployment TEAs have changed. MSAs, counties, cities with a population greater than 20,000 and outside of an MSA, and census tracts can all qualify individually if their unemployment rate is at least 150% of the national unemployment rate.[2] Additionally, a high-unemployment TEA may also consist of a combination of “directly adjacent” tracts, if the weighted average unemployment rate of the combined tracts is at least 150% of the national unemployment rate.

Over the course of the many months since the new rules took effect, we have been tracking the frequent questions that our clients and colleagues in the EB-5 industry have had for us. Read further for our responses to these questions.

Q: Since USCIS is no longer recognizing TEA letters provided by the states, how do I obtain a TEA certification?

A: Under the new rules, evidence that the Project site qualifies as a TEA must be submitted with each investor’s I-526 application and will be reviewed by USCIS as part of the I-526 review. Instead of including a state-issued certification as was done under the old rules, each petition should include an independent analysis as evidence. USCIS will not be providing a separate process for reviewing TEA certifications. So, the TEA for a project will not be officially approved by USCIS until the I-526 is adjudicated. As of March 16, 2020, I-526 processing time posted by USCIS is between 33 and 50 months.[3]

Q: What evidence needs to be presented to USCIS to show that a Project site qualifies as a TEA?

A: The evidence submitted to USCIS as part of the I-526 petition must show that at the time of investment or I-526 filing (whichever came first), the Project site met the new requirements for TEA qualification. The evidence should include the source of the data used to determine the labor statistics of the MSA, county, city, or census tract(s), the TEA unemployment threshold, a map showing the project site and the county, city, or census tract(s) included in the TEA, the labor statistics (civilian labor force, employment, unemployment, and the unemployment rate) of the county, city, or census tract(s), and the weighted average unemployment rate of the combined census tracts if the TEA relies on census tract combination. If you would like assistance putting together the evidence that your project site qualifies as a TEA, please contact us at [email protected] or [email protected].

Q: What data can be used to determine the unemployment rate for census tracts?

A: USCIS stated that the data you present must be “reliable and verifiable.” USCIS also stated that unemployment data published by ACS and BLS qualify as reliable and verifiable data sources, so these are the two datasets we use to determine TEA eligibility. Using data from ACS and BLS, there are two methods that it appears USCIS will accept to determine the census tract unemployment rates: the ACS-only method and the census-share method.[4] The ACS-only method relies only on the most recent data from the ACS 5-year estimates of labor statistics at the census tract level.[5] The census-share method, used by most states under the old rules, consists of a few different calculation steps that first uses the ACS data and then takes an extra “trending” step utilizing more recent BLS LAUS annual average data at the county level before arriving at the final answer.[6] There is no BLS-only method for census tracts, because BLS does not publish labor force data at the census tract level.

Q: Are there any datasets besides the ACS 5-year estimates and BLS annual averages that can be used to as evidence that a Project site qualifies as a TEA?

A: Since USCIS only limited the datasets to those that are “reliable and verifiable,” presumably they would accept datasets other than the ACS 5-year estimates and BLS annual averages as evidence that a Project site qualifies as a TEA. However, it is unclear what these other data sources might be. In order to protect investors, until we get feedback from USCIS in the form of I-526 adjudications or further public communications, we believe the only safe datasets to use to determine TEA qualification are the ACS 5-year estimates and the BLS annual averages. If you’d like to discuss other potential data sources or methodologies, please contact us at [email protected] or [email protected].

Q: What is the unemployment threshold for TEA qualification?

A: The qualification threshold for TEAs depends on which dataset and methodology is used to calculate the labor statistics of the census tract(s). According to USCIS, regardless of with data is presented, the data must be internally consistent, so if ACS data is used to calculate the unemployment rate for the tract(s), then ACS data must be used to determine the national unemployment rate, and if the census-share method is used to calculate the unemployment rate for the tract(s), then BLS data must be used to determine the national unemployment rate.[7] Under the ACS-only method, using ACS 14-18 (the latest available as of the time of this article), the qualifying high unemployment rate for TEAs is 8.9% (150% of the ACS 14-18 civilian unemployment rate of 5.9%). Under the census-share method, using a combination of ACS 14-18 and BLS CY18 (the latest finalized calendar year BLS data available as of the time of this article), the qualifying high unemployment rate for TEAs is 5.9% (150% of the 2018 BLS national annual average civilian unemployment rate of 3.9%).

Q: Since the census-share method has a lower threshold (5.9%) than the ACS-only method (8.9%), why don’t you just always use census-share and compare to the 5.9% threshold? 5.9% is much lower than 8.9% so shouldn’t that be easier to make a TEA work?

A: The two separate methodologies result in two different “time-period” results and they have to be compared to different threshold rates, as noted by the language from the new rules:

“If petitioners rely on ACS data to determine the unemployment rate for the requested TEA, they should also rely on ACS data to determine the national unemployment rate [sic] to which the TEA is compared.”

ACS-only is a 5-year average result, and must be compared to the same national unemployment rate over that same time period. The latest “ACS-only” data is 2014-2018 and 150% of the national unemployment rate from ACS 2014-2018 is 8.9% (150% of 5.9%) and so that is why an “ACS-only” calculation must be compared to an 8.9% national threshold.

Census-share is a single year result (that combines the ACS-data used above with an additional step of “trending” it forward based on more recent county-level data from BLS). The latest finalized calendar year data available from BLS as of the date of this article is CY18 so the “result” under census-share is a CY18 result. 150% of the national unemployment rate during CY18 was 5.9% (150% of 3.9%) and so that is why a “Census-share” calculation must be compared to a 5.9% national threshold.

Q: Do the two different methodologies (ACS-only and Census-Share) usually differ?

A: If one method works as a TEA, usually the other one does as well, since the ACS census tract data is the main driver of both calculations. However, if the county-wide unemployment rate has not improved at the same rate as the national unemployment rate between the time period of 2014-2018 (the ACS time period) and 2018 (the BLS time period), then it is possible that census-share might work if ACS doesn’t. Conversely, if the county-wide unemployment rate has improved more substantially than the national unemployment rate between the time period of 2014-2018 (the ACS time period) and 2018 (the BLS time period), then it is possible that ACS-only might work if census-share doesn’t.

Q: Is one methodology better than the other?

While our best interpretation of the Final Rule is that DHS will accept census-share or ACS-only, it doesn’t seem like one is necessarily “better” than the other in the eyes of USCIS. Census-share is what the states used in the USCIS-approved letters for years under the old rules, while the ACS-only approach seems to be more specifically referenced in some of the language in the Final Rule. When we review a location for TEA-eligibility, we check both methods and let the client know if only one of them works (both work for the majority of locations that qualify as TEAs).

Q: When does the ACS and BLS data that are used in these TEA calculations get updated?

A: ACS data is updated in late December and BLS LAUS annual averages at the county-level are finalized in late April.

Q: When do I need a new TEA analysis/letter?

A: The timing of TEA letter data is a gray area. Under the old TEA rules, the census-share method was utilized by the majority of states, and states updated their data once a year, when the new BLS annual average data was finalized in April. Some states claimed that their certification letters were valid for a year (or sometimes longer), but in practice USCIS did not always recognize those validity periods. For example, USCIS has issued RFEs that state “…the TEA letter is only valid until new unemployment estimate data is available”, so it was generally considered safest to file TEA letters based on the most recent data that the state was using at the time of the investment or I-526 filing (whichever came first). So, TEA letters were generally considered to be valid from around April to April each year under the old rules. Under the new rules, it’s unclear whether USCIS will continue to accept evidence based on the census-share method that is updated only in April when the new BLS data is released, or if it will require census-share data to be updated twice a year: once when the BLS data is released in April and again when ACS data is released in December. Remember, the timing of TEA evidence is investor specific; TEA evidence needs to be based on the most recent available data for each investor. As long as new investors are being added to a Project, we recommend that TEA evidence based on the census-share method be updated in April and again in December and that TEA evidence that is based on the ACS-only method be updated once a year, in December.

Q: How do I know if my site will continue to qualify as a TEA?

A: While some TEAs are so significantly above the threshold that they are almost certain to stay a TEA from year to year, for many locations it is difficult to tell. We can analyze the margin between the unemployment rate of the tract(s) and the TEA threshold, the number of bordering tracts with an unemployment rate greater than the TEA threshold, and the historic year-over-year unemployment rate changes of the Project tract(s) and adjacent tracts to estimate the likelihood that a tract will continue to qualify as a TEA when the data updates. However, given the relatively small labor force of most tracts and the difficulty in estimating how a single tract’s unemployment rate is likely to change compared to the national unemployment rate, for some TEAs, it is difficult to say with confidence that a tract(s) that qualifies as a TEA at any single point in time will continue to qualify as a TEA as new data is released.

Under the old rules, we could almost always “rescue” a TEA from year to year, if needed, since most states were relatively flexible on how you could aggregate tracts, and in some cases, block groups. However, now that we are restricted to only using tracts that border the project tract (“directly adjacent”), if the same exact TEA configuration of tracts that was used one year falls out of TEA-eligibility the next year, we don’t have many options to try and save it by finding other combinations (or using block groups, which are no longer permitted).

Q: How many tracts can I combine to create a TEA?

A: USCIS does not have a specific limit on the number of tracts that can be combined, but combination is limited to the project tract(s) and any or all “directly adjacent” (bordering) tracts.[8]

Q: Are tracts that border each other only at the corner “directly adjacent”?

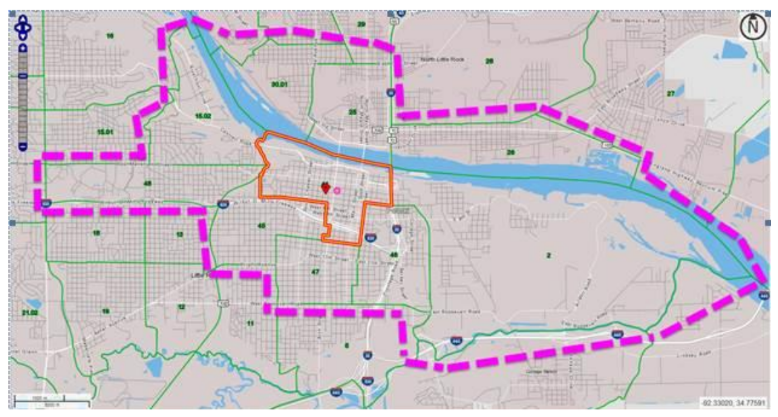

A: When USCIS published the Notice of Proposed Rulemaking (NPRM) on January 13, 2017,[9] they included a map (shown below) that demonstrated the meaning of “directly adjacent.”[10] According to USCIS, all of the tracts within the dashed border are considered directly adjacent to the Project tract (the tract with the thick orange border), including the tract to the northeast, which borders the Project tract only at the corner.

The Final Rule[11] does not include a similar map, but since the “directly adjacent” language did not change significantly between the proposed rule and the final rule, our best guess is that USCIS will allow a tract that borders the project tract only at the corner to be included in a TEA calculation. Hopefully USCIS will clarify this issue at some point so the industry can have more certainty.

Q: Are tracts that cross bodies of water “directly adjacent?”

A: Similar to the tracts that border each other only at the corners, the map from the NPRM also includes tracts that cross over a body of water (the border they share is entirely in the water), so our best guess is that USCIS will allow a tract that touches the project tract by crossing a body of water to be included in a TEA calculation. Hopefully USCIS will clarify this issue at some point so the industry can have more certainty.

Q: Can cities within an MSA qualify as a TEA at the city level?

A: In the Final Rule and in the policy memo,[12] cities that fall within an MSA are not included in the list of entities that can qualify as high unemployment TEAs on their own, so we do not recommend submitting evidence of TEA qualification to USCIS based on the unemployment rate of a city that falls within an MSA.

The information and opinions provided here

are for informational purposes only and do not constitute legal advice. The information

and opinions here are intended to guide your conversations with experienced

EB-5 attorneys and other professionals. You should not act or rely on any

information without first seeking the advice of an attorney.

[1] https://www.federalregister.gov/documents/2019/07/24/2019-15000/eb-5-immigrant-investor-program-modernization

[2] https://www.uscis.gov/policy-manual/volume-6-part-g-chapter-2

[3] https://egov.uscis.gov/processing-times/

[4] The census share method was the generally accepted method for determining TEA qualification by states prior to the implementation of the new TEA rules by USCIS.

[5] U.S. Census Bureau, Employment Status for the Population 16 Years and Over ACS 5-year estimates. Data set available at https://data.census.gov/cedsci/.

[6] Labor Force Data by County, 2018 Annual Averages. https://www.bls.gov/lau/laucnty18.txt

[7] https://www.federalregister.gov/d/2019- 15000/p-375

[8] https://www.federalregister.gov/d/2019-15000/p-115

[9] https://www.federalregister.gov/d/2017-00447/p-1

[10] https://www.federalregister.gov/d/2017-00447/p-195

[11] https://www.federalregister.gov/documents/2019/07/24/2019-15000/eb-5-immigrant-investor-program-modernization

[12] https://www.uscis.gov/policy-manual/volume-6-part-g-chapter-2