How Can We Help?

Adjust the Value of Taxable Property

Impact DashBoard estimates property taxes for each Taxing District by converting Capital Investments into Taxable Property before applying local tax rates. You have access to parameters to fine tune the assumptions that take Capital Investment inputs and translate into Taxable Property.

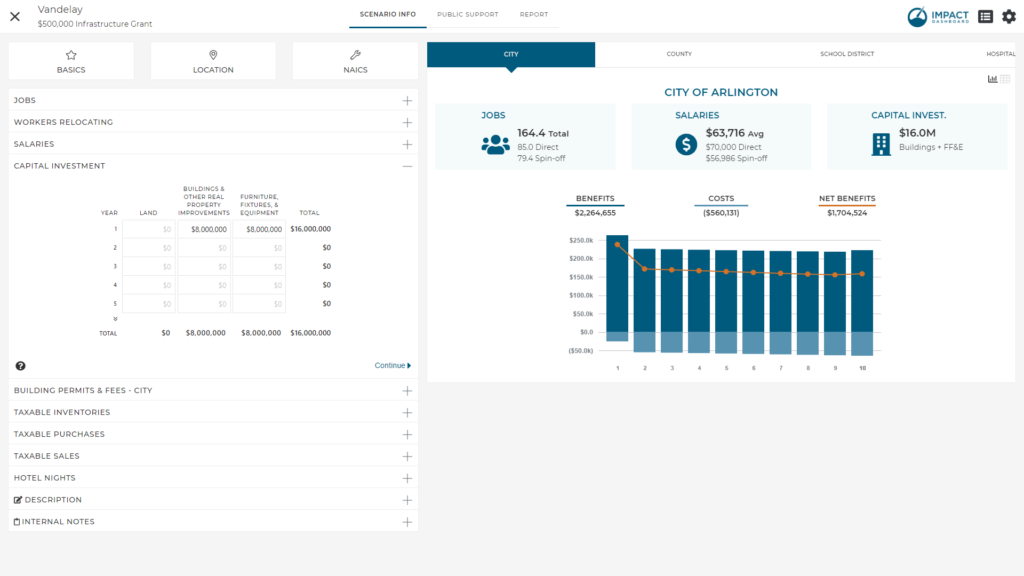

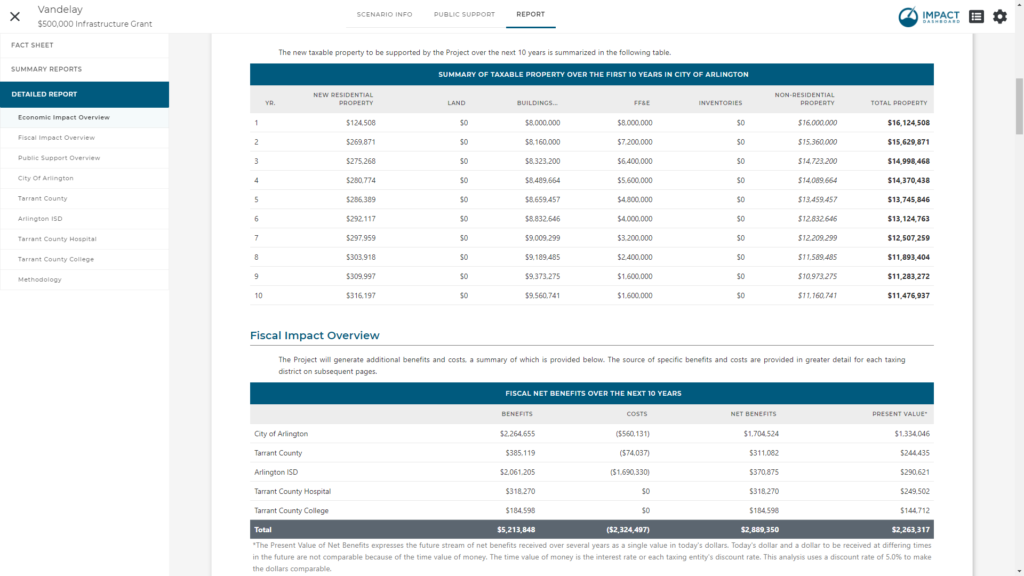

To see how this transformation takes place, you will want to focus on (1) the Capital Investment inputs on the Scenario Info page, (2) General Assumptions tab of the Settings page, and (3) a table on the Detailed Report called “Summary of Taxable Property” which is the third table under the Economic Impact Overview section.

Essentially, the Capital Investments are entered on the Scenario Info page, parameters from the General Assumptions are used to generate the Summary of Taxable Property shown on the Detailed Report.

There are three main parameters that allow you to adjust how Taxable Property is estimated in Impact DashBoard which are detailed below.

Here’s a video if you prefer to just watch and listen.

Change Percent of Building and Improvement Costs That Represent Market Value

Without any other information, Impact DataSource suggests the cost to construct a building is a reasonable estimate of the market value of the property once constructed. In some instances, this assumption may need to be modified.

How to Change Percent of Building and Improvement Costs That Represent Market Value

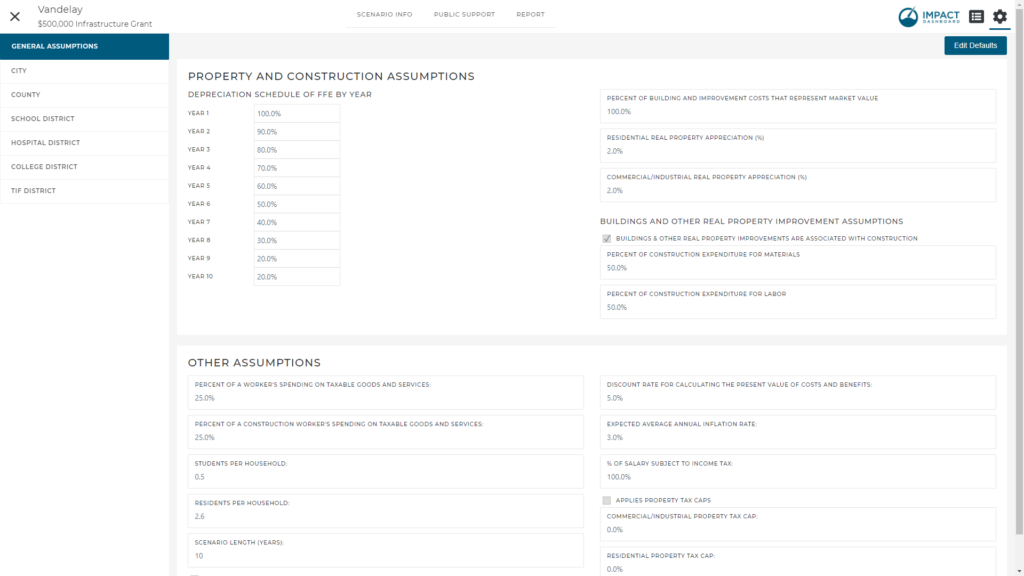

- Click on Settings (gear icon) from the Scenario Workspace.

- On the General Assumptions tab, click Edit Defaults (or confirm it has already been clicked) so that you can make changes.

- Find the input called “Percent of Building and Improvement Costs That Represent Market Value” and enter the desired value.

The Building and Other Real Property Improvements entered on the Scenario Info page are multiplied by the parameter “Percent of Building and Improvement Costs that Represent Market Value” to determine Market Value. The Taxable Value is simply the Market Value of the property multiplied by the Assessment Ratio for the Taxing District. In Texas, the assessment ratio is 100% so Market Value is equal to Taxable Value. If your local property tax calculations include an assessment ratio not equal to 100%, you will see the assessment ratio applied to the Market Value before appearing in the Taxable Value table.

Change the Real Property Appreciation Rate

Real property tends to increase in value over time. Your Impact DashBoard account will have an assumption for real property appreciation that can increase (or decrease) the value of Real Property added to the tax rolls.

How to Change Percent of Building and Improvement Costs That Represent Market Value

- Click on Settings (gear icon) from the Scenario Workspace.

- On the General Assumptions tab, click Edit Defaults (or confirm it has already been clicked) so that you can make changes.

- Find the input called “Commercial/Industrial Real Property Appreciation” and enter the desired value.

The value of Land and Building Improvements will increase each year based on the annual appreciation rate.

Note: You can enter a negative value for appreciation to model a reduction in real property value over time

Change the Depreciation Schedule for FF&E

Investments in Furniture, Fixtures, & Equipment (FF&E) tends to decrease in value over time. Your Impact DashBoard account will include a depreciation schedule for FF&E

How to Change the Depreciation Schedule for FF&E

- Click on Settings (gear icon) from the Scenario Workspace.

- On the General Assumptions tab, click Edit Defaults (or confirm it has already been clicked) so that you can make changes.

- Find the input called “Depreciation Schedule of FFE by Year” and enter the desired values.

Note: The depreciation schedule will apply to investments made over time as well. So, if you have FF&E investments made in Year 1 and Year 5, the value of FF&E in Year 5 will include the property added in Year 1, depreciated through 5 years of the deprecation schedule and the property added in Year 5 with just 1 year of depreciation.

In most instances, the FF&E investments will include a variety of different types of property subject to a variety of depreciation schedules. The default depreciation schedule is intended to capture the concept of depreciation so that taxes on FF&E are not over estimated. You can enter a specific depreciation schedule based on FF&E investments if you choose.