Unless something stops them, the new EB-5 regulations will go into effect on November 21, 2019. By now, you have probably heard the main takeaways related to the TEA-related changes

- Census tract combination for high-unemployment TEAs would be limited to the project tract(s) plus some or all of the tracts that are “directly adjacent” to the project tract (i.e. you can only use the tracts that touch the project tract for aggregation to try and meet the required threshold)

- TEA minimum investment = $900,000 while Non-TEA minimum investment = $1.8M

- States are removed from the process – DHS takes over TEA determinations

While the last half of this article will cover the new census tract limitations in more detail, we wanted to discuss a few other items first: (1) what data/methodologies must be used for unemployment rate calculations, and (2) how and when do you know if your TEA has been approved?

What data must be used for unemployment rate calculations?

DHS says it will not provide one specific set of data petitioners can use to demonstrate that their investment is being made into a TEA. The petitioner must provide evidence that the area qualifies as a high unemployment area. DHS does state that unemployment data provided by the U.S. Census Bureau’s American Community Survey (ACS) and the Bureau of Labor Statistics (BLS) qualifies as reliable and verifiable data for petitioners to use.

In other words, it seems there might be bit of flexibility on the methodology that can be used to calculate unemployment at the census tract level. Most or all states currently use census-share methodology for TEA calculations. Census-share calculations use both datasets mentioned above (ACS and BLS) to arrive at the unemployment rate at the tract level. Since the overwhelming majority of I-526s are currently filed using a state-issued TEA letter that relies on census-share calculations, I thought that DHS might explicitly say that census-share must be used. However, it looks like they might also accept other methodologies, such as a straight-up ACS calculation (without any census-share application), which in certain areas would be more beneficial in trying to meet the threshold. In fact, USCIS provides specific reference in the final rule notice that indicates a straight-up ACS calculation may be utilized, as long as it is correctly compared to the straight-up ACS national average unemployment rate.

If petitioners rely on ACS data to determine the unemployment rate for the requested TEA, they should also rely on ACS data to determine the national unemployment area to which the TEA is compared.

While USCIS provides language such as in the above to seemingly discuss an “ACS-Only” calculation, they do not specifically mention an example with census-share. Census-share is only mentioned once in the final rule notice, referring to a comment submitted. I would have thought that using census-share would still be the safest route, since USCIS is used to seeing that come from the State-issued letters, but the fact that the final rule notice seems to specifically provide language about an “ACS-only” calculation, but only mentions census-share once referring to a user comment, it would appear that an “ACS-only” calculation may be sufficient.

It will be interesting to see how the EB-5 industry takes to this lack of clarity and how DHS adjudicates the different TEA methodologies (which unfortunately will be adjudicated along with the I-526 – there will not be separate application or process for obtaining an early TEA approval). Since it will now be up to the petitioner to provide their own evidence that a project qualifies as a TEA based on the new language (instead of just providing a state-issued letter as is done currently), it will be of the upmost importance that the TEA analysis and supporting documentation is done accurately to meet the new rules.

The Final Rule DOES NOT establish a separate application or process for obtaining TEA designation from USCIS prior to filing the EB-5 immigrant petition and USCIS will not issue separate TEA designation letters for areas of high unemployment.

So, unfortunately but not surprisingly, it looks like we will have to wait until the I-526 is adjudicated to hear back on a firm yes or no. With DHS not providing a single dataset or methodology to be used for TEAs, this could be two years or more (based on recent adjudication times) as DHS will review the TEA designation evidence with the Form I-526 petitioner’s filing to determine eligibility at that time.

Due to adjudication processing times for I-924 applications and I-526 and I-829 petitions that are already exceedingly long, the possibility of DHS taking over TEA designation requests has been of great concern for EB-5 stakeholders.

The rest of the article goes into more detail about the census tract limitations discussed at the beginning and some other items of note.

Limits on census tract aggregation

The Final Rule limits the number of census tracts that can be combined for purposes of high-unemployment TEAs. Once the Final Rule goes into effect, high-unemployment TEAs will be limited to the following, so long as the weighted average of the tract or tracts is at least 150 percent of the national average:

- a census tract or contiguous census tracts in which the new commercial enterprise is principally doing business (i.e. the project tract(s)) or

- the project tract(s) and any or all additional tracts that are directly adjacent to the project tract(s)

In short, if the project tract (or tracts – for projects that span more than one tract) does not qualify on its own, the only census tracts that can be combined to form a high-unemployment TEA are the tracts immediately adjacent to the project tract(s).

In current practice, most high-unemployment TEAs involve the aggregation of multiple contiguous census tracts (or block groups, as discussed later). Furthermore, states currently have flexibility in certifying the “areas” or “shapes” of the TEA. DHS notes that this “reliance on states’ TEA designations has resulted in the application of inconsistent rules by different states” and has “resulted in the acceptance of some TEAs that consist of areas of relative economic prosperity linked to areas with lower employment.” To try to counteract this, DHS is implementing a significantly stricter regulation regarding census tract aggregation.

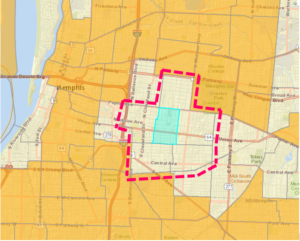

DHS provided the following map and corresponding description as an example of how high unemployment areas would be designated.

The broader area outlined in a dashed bold line contains all of the tracts that are adjacent to the project tract. Under the proposed regulation, the tract outlined in a solid bold line may independently qualify as a TEA. If it does not, an area consisting of that tract and any or all of the additional tracts outlined in the dashed bold line could qualify as a TEA, so long as the weighted average of the combined unemployment rates of each tract is at least 150% of the national average.

The new rule on the aggregation of census tracts is a significant departure from current practice and a majority of current EB-5 projects would not qualify as a TEA under the new rule. For example, we analyzed a census tract in downtown Memphis under the current TEA standards versus the Final Rule. Since neither the city of Memphis, the MSA containing Memphis, or county containing Memphis qualifies as a high-unemployment TEA on its own, we turned to census tracts for a possible high-unemployment TEA.

In the following maps, high unemployment census tracts are shown in orange, with the project census tract highlighted in light blue. As the maps demonstrate, downtown Memphis has a significant number of high-unemployment census tracts.

Under the current rules, the site in the map below would be TEA-eligible by a relatively simple and reasonable combination of only three tracts (one of several possible reasonable combinations). This type of combination would currently be certified painlessly by almost all states.

Next, we analyzed that census tract under the Final Rules. As shown in the map below, the example project census tract is not touching any other high unemployment census tracts, and so it would not be possible to construct a TEA under the Final Rule.

This example is not unique, as the Final Rule would result in similar limitations throughout the United States. In Memphis, like many cities, higher unemployment areas are highly concentrated in a certain area of the city, as opposed to being scattered throughout.

Other Important Notes Related to High-Unemployment Areas

Block Groups – no longer permitted. Only census tracts may be used.

A block group is a smaller sub-area than a tract, as each tract is made up of one or more block groups. While in current practice, tracts are the typical building blocks of a TEA, several states (New York, Washington, Oregon, New Mexico, several cities in Texas, and others) currently utilize block groups when determining TEA-eligibility. Block groups can provide a significant amount of flexibility, due to the use of a smaller subarea.

The Final Rule only includes census tracts, and does not allow the TEAs based on block groups, which is another way that the Final Rule reduces the number of areas that qualify for TEA designation and the lower investment amount.

Rural Area Definition

The Final Rule does not impact “rural areas,” as the Final Rule merely clarifies the existing language defining a “rural area.”

Questions or concerns? Please call Michael at 316 670 0044, or e-mail [email protected] or click here.